Why Invest with Uatter Investments?

Uatter, pronounced as “Wa-ter” , was founded by Jeremy Steele with the purpose of acquiring hotels in the right locations and then repositioning them for their highest and best use that will produce the highest cashflow. As water flows it creates life and so, as real estate assets like hotels produce more cashflow, it brings life to the communities and the employment to thousands of people in those communities.

Highly Selective & Conservative Underwriting

Buying in the Right Location

Backed by Hotel Investing Experience

Our Team

Meet Our Leadership Team

Jeremy Francisco Steele

Founder

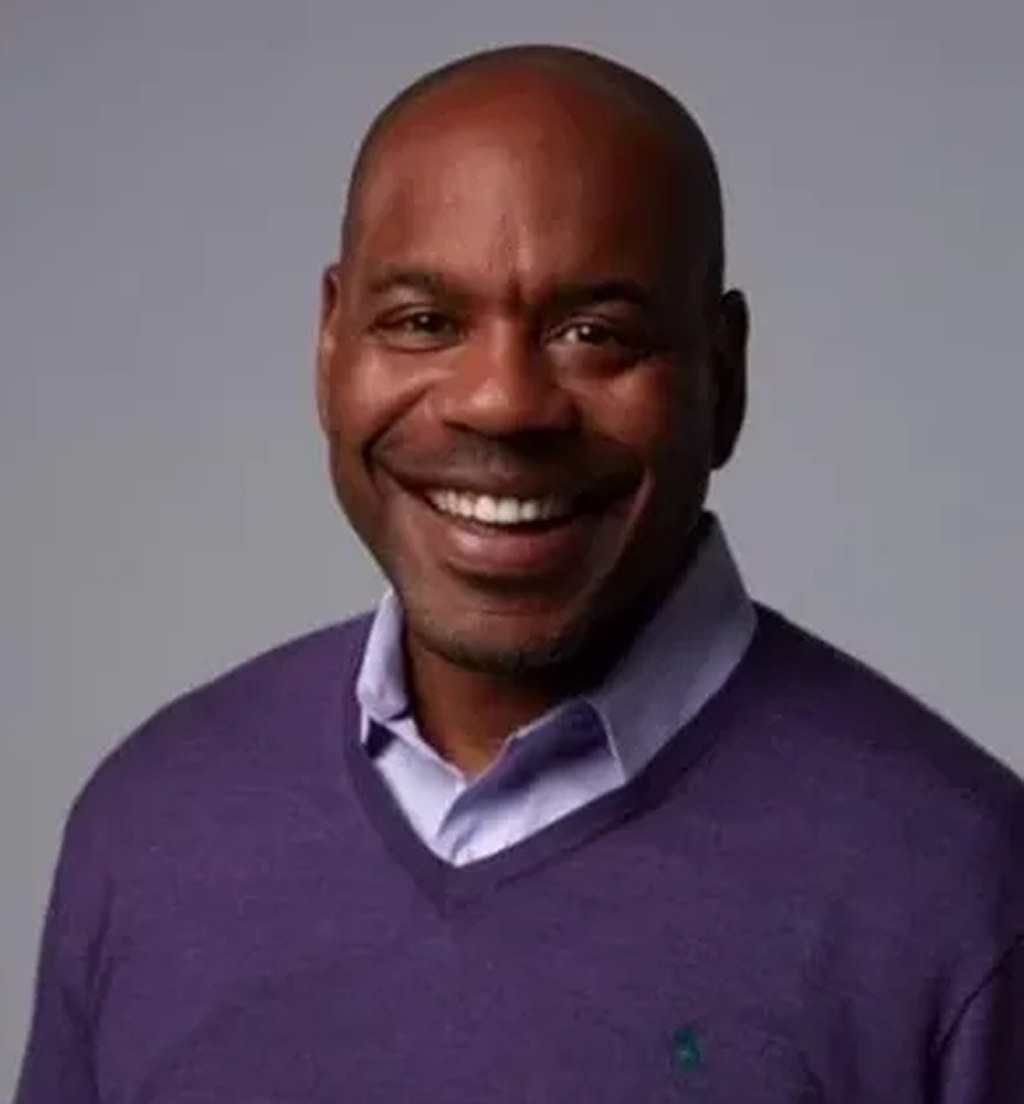

Michael Ealy

Real Estate Strategist

Interested in Investing in Hotels?

Our Track Record

Experience: Over 5,000 hotel keys worth over $1.5 BILLION – are being managed by our hotel operator-partner

Expertise: value-add and turning non-performing hotels into money-making assets

Most Recent Successes

We aim to get projects with a minimum IRR of 30%.

How do we get extremely profitable projects?

We get off-market hotel and apartment deals and we implement our value-add strategies cost-effectively.